As the world prepares for another round of climate negotiations in Paris starting Nov. 30, it is worth repeating a few simple points.

It is becoming increasingly obvious that the world is already paying a substantial price for global warming. Sure, extreme weather events will never come with a stamp that says “caused by global warming.” But we know that global warming will change weather patterns in ways that are not entirely predictable. That means that we will see unusual weather events where global warming was likely a factor, but we can never know for certain.

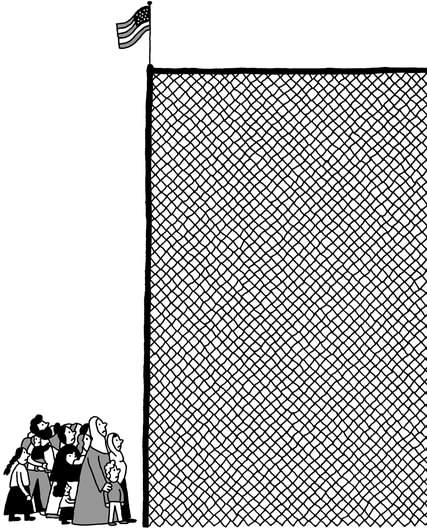

One of the leading candidates in this respect is the extreme drought that afflicted Syria in the last decade, destroying much of its agriculture and leading to a mass migration to its cities. This migration was likely a factor in the unrest that led the country’s civil war starting in 2011. Syria’s conflict in turn has led to hundreds of thousands of deaths, the displacement of millions, and of course the rise of the Islamic State in Iraq and the Levant (ISIL).

It is likely that we will see, or are already seeing, other weather disruptions with comparable human consequences. Unfortunately, there has been much attention to low-lying and relatively sparsely populated islands as the main victims of global warming. In fact, there will almost certainly be hundreds of times more victims in relatively densely populated areas facing droughts or countries such as Bangladesh, which could be hit by devastating floods.

The time has long since passed for arguing about whether global warming is happening or whether the consequences will be serious. The question is what we are prepared to do about it. Here also, we have seen reality largely turned on its head.