Last week I wrote about what in our macroeconomic models has and hasn’t worked since 2008. As I said, demand-side events have been very much what people using IS-LM would have predicted (and did). But on the supply side, not so much. For one thing, the “accelerationist” doctrine that has dominated economic discussion of inflation and unemployment for 40 years has fallen flat. If inflation had responded to the Great Recession and aftermath the way it did in previous big slumps, we would be deep in deflation by now; we aren’t.

Now, the usual response from model-oriented public officials and research staff at policy institutions is to say that what they work with now is a Phillips curve with “anchored” expectations. The idea is that price- and wage-setters now act as if they expect policymakers to hit their 2 percent target, and don’t change their expectations in the face of recent experience. Operationally, of course, such a curve looks just like the old, pre-NAIRU Phillips curves people estimated in the 1960s. And the truth is that such curves fit pretty well on data since 1990.

But this kind of anchoring argument, I would argue, leaves us with some disturbing questions, both conceptual and practical.

First, on the conceptual side, where does anchoring come from and how far can it be trusted? Is it the consequence of central bank credibility, or is it just the consequence of low inflation: people stop paying much attention to fluctuations in inflation when it’s in the low single digits? Will the anchoring go away if inflation is persistently 1 rather than 2 percent; would it go away if inflation rose to 3 percent?

Second, on the practical side, the anchored-expectations hypothesis tells a very different story about capacity and policy than previous approaches.

Let me illustrate this point with the case of the euro area.

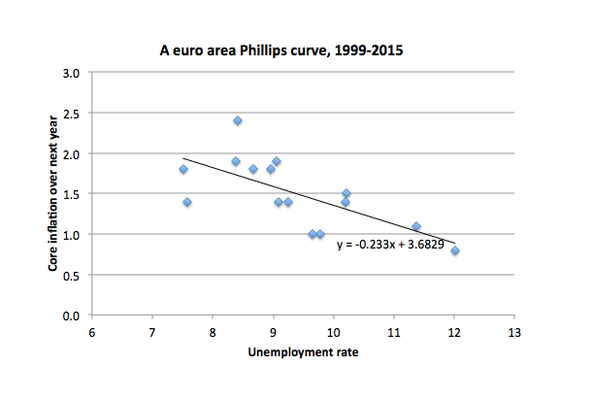

If we use aggregated data for the euro area as a whole, a simple old-fashioned Phillips curve works surprisingly decently:

In fact, the slope of the curve is quite close to the estimate for the US from Blanchard et al.

What’s worth pointing out, however, is that if we take this result seriously, it implies that the euro area is much more deeply depressed than generally acknowledged, and that the ECB’s attempt to get inflation back up close to 2 percent is a much more daunting challenge, than anyone seems to acknowledge. Euro core inflation is currently about 1 percent; the slope of the Phillips relationship is around 0.25; so getting back to 2 should require a 4 percentage point fall in unemployment. That’s a lot!

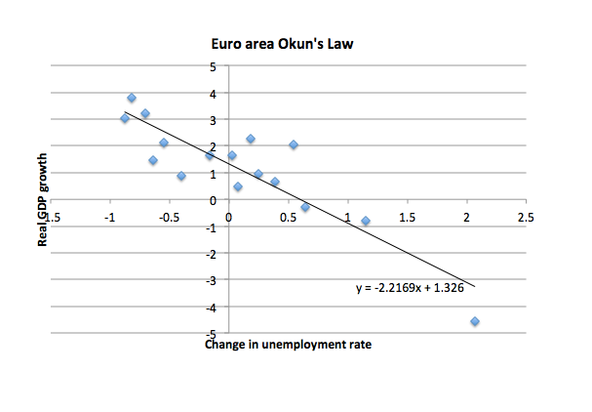

How much output growth would this involve? An Okun’s Law type relationship also works pretty well for the euro area as a whole, and gives a coefficient close to the US level:

So a 4 percentage point decline in unemployment would, if the historical relationship holds, mean 8 percent more in real GDP — that is, this naive calculation puts the euro area output gap at 8 percent, which is huge.

Should we take this seriously? If not, why not?