As many of us have noted, it’s hugely unfair when people claim that Greece has done nothing to adjust. On the contrary, it has imposed incredibly harsh austerity and substantial reforms on other fronts. Yet you might be tempted to argue that the results show that Greece hasn’t done enough — after all, last year it was running only a tiny primary budget surplus (that is, not counting interest), and this year it has slipped back into primary deficit. So more adjustment is needed, right?

Well, step back for a minute and imagine that we weren’t talking about Greece but about the U.S. or the UK. When we look at our budgets, we normally focus not on the headline budget balance but on the cyclically adjusted balance — an estimate of what it would be at more or less full employment. This helps avoid pressure to pursue procyclical policies that make the economy unstable, and also gives a better idea of the long-run sustainability of the position. And while cyclical adjustment can be controversial, there are standard estimates from third parties like the IMF and the OECD.

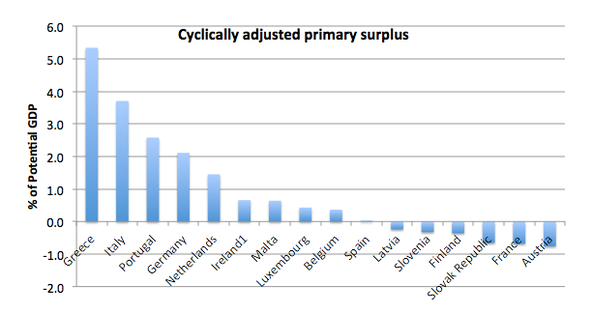

So here’s a picture you probably haven’t seen: the IMF’s estimates of the cyclically adjusted primary balances of eurozone countries in 2014:

Greece is, by this measure, the most fiscally responsible, indeed crazily austere, nation in Europe.

So why is it in fiscal crisis? Because the economy is deeply depressed.

Suppose that there were a way to end this depression. Then Greece’s fiscal problems would melt away, with no need for further cuts. But is there any way to do that?

The answer is, not as long as Greece remains in the euro. It can pursue reforms that might make it more competitive, but anyone promising dramatic, quick results has no idea what he is talking about.

On the other hand, Grexit would produce a rapid improvement in competitiveness, at the cost of possible financial chaos.This is not a route anyone has been willing to go down, but one does have to say that as the crisis worsens it becomes a more plausible outcome.

The thing to understand, in any case, is that if Grexit does come, fiscal issues will immediately cease to be central to the story. Instead, it will all be about handling bank panic, managing the transition to a new currency, and possibly removing structural obstacles to increased exports (which would very much include tourism).

In truth, this has never been a fiscal crisis at its root; it has always been a balance of payments crisis that manifests itself in part in budget problems, which have then been pushed onto the center of the stage by ideology.