Barry Eichengreen asks himself why his influential analysis, suggesting that the euro was irreversible now appears wrong. Surely in a direct, mechanical sense what we’re seeing is the process I warned about five years ago:

Think of it this way: the Greek government cannot announce a policy of leaving the euro — and I’m sure it has no intention of doing that. But at this point it’s all too easy to imagine a default on debt, triggering a crisis of confidence, which forces the government to impose a banking holiday — and at that point the logic of hanging on to the common currency come hell or high water becomes a lot less compelling.

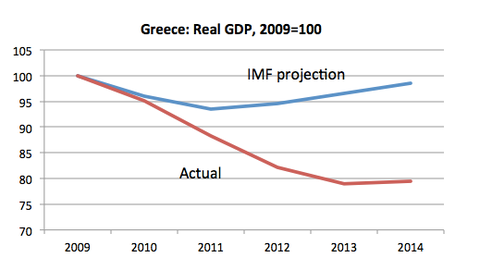

But doesn’t the ultimate cause lie in wild irresponsibility on the part of the Greek government? I’ve been looking back at the numbers, readily available from the IMF, and what strikes me is how relatively mild Greek fiscal problems looked on the eve of crisis.